If you’re new to investing in commercial real estate, you might be curious exactly how the value of a property is calculated. For single-family, the value is determined by the market, so your best bet for establishing how much a property is worth involves looking at residential sales comparables (or comps) in the area.

But one of the benefits of multifamily is the fact that you can influence a building’s value by increasing the amount of money it generates. What other factors (beyond income) go into assessing the value of commercial real estate? How do you do the math for any given multifamily property?

To find out, watch my video below (or keep on reading):

The Value-Add Strategy

Imagine there are two apartment buildings of similar size and circumstance located in the same neighborhood, one valued at $2M and the other at $2.5M. Our business model involves finding the $2M property and making changes that increase the amount of revenue it generates. Most commonly, this involves renovating the units, adding amenities and improving curb appeal—which allows us to raise rents.

Increasing our overall income increases the value of the property, making it worth $2.5M, just like the building down the street. Now we can either sell it for a profit OR do a cash-out refinance. The beauty of the second option is that it allows us to return the investor’s principal while they continue to get checks in the mail based on the building’s cashflow!

By The Numbers

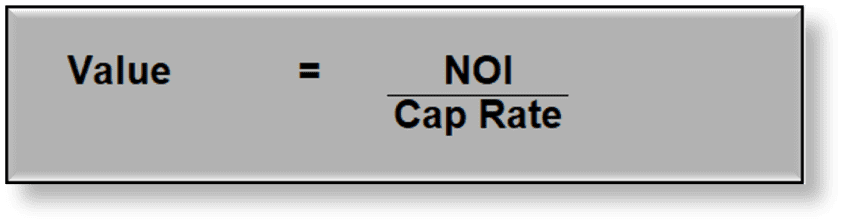

The question is, how do we know that property increased from a value of $2M to $2.5M? Here’s the formula for determining a building’s worth:

Coming up with a building’s “net operating income” or “NOI” for short is pretty straightforward: it’s the property’s income minus its expenses (but before the mortgage payment – also called “debt service”).

The other variable is the capitalization rate, usually referred to as the cap rate. And that number requires a little additional explanation.

Feather in Your Cap

The first thing you need to understand is that the cap rate reflects the expected return on an investment property, and it is expressed as a percentage of the investment’s original cost. Also important to note, the cap rate has an inverse relationship with the value of a property. In other words, the lower the cap rate, the higher the price and the higher the cap rate, the lower the price.

So, a property with a lower cap rate is more profitable, right? Well, it’s not quite that simple. The cap rate is determined by the market and varies by asset type (office space, self-storage, multifamily, etc.), asset class and geography. Your broker or appraiser will know the cap rate based on comparable properties in the area, but in general, a class D building in a run-down area will have a higher cap rate, while a class A multifamily property in an upscale, gated community will have a lower one.

Think of it this way: We can live with lower returns when the cap rate is low because we are working with less risk. On the other hand, we want to be sure that our return will be high if we take on the challenges associated with a higher cap rate, like lower demand in a rural community or security concerns in a blighted area.

Doing the Math

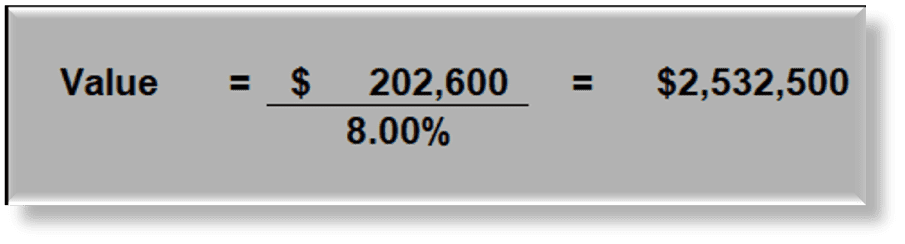

So, let’s walk through an example and apply some real-world numbers to our formula.

Let’s say we purchased this building for $2M. By increasing our NOI to $202,600 annually, at a cap rate of 8%, this particular multifamily property is now valued at about $2.5M. Here’s the math for our improved property:

The crucial takeaway here is that commercial real estate is valued based on its income. Increase the income and you raise the value of the property.

If you’re interested in passively investing in one of our upcoming multifamily syndications, please join the Nighthawk Investor Club.

If you’re ready to take your active investing to the next level, consider joining our Investor Incubator mentoring program. To find out if it’s a fit for you, please schedule a free strategy call with us.